1099-G Tax Information

Unemployment insurance payments are taxable income. For all unemployment claimants that received benefits in 2024, the 1099-G form is now available on UI Online. Claimants will also receive a copy by mail.

The form will show the amount of unemployment compensation you received during 2024, and any federal and state income tax withheld. Taxpayers report this information, along with your W-2 income, on your 2024 federal tax return.

Access your 1099-G on UI OnlinePlease note: If you received unemployment benefits in 2024 from a state other than Rhode Island, you will need to contact that state’s Labor department or unemployment office for your 1099-G.

Troubleshooting

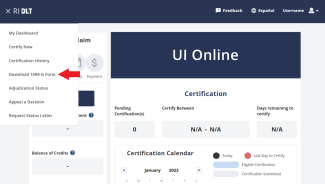

To access your 1099-G, login to UI Online and select Download 1099-G Form under My Dashboard

The amount in line 1, Unemployment Compensation, reflects the total amount of unemployment benefits. If you chose to have taxes withheld, the amount of taxes withheld is in line 4 and line 11. Please double check whether you are factoring in the taxes withheld when comparing the 1099-G form with your bank records.

If you still believe the 1099-G does not reflect the correct amount, please submit the UI Help Form or contact the UI Call Center at (401) 415-6772 to confirm the information and request a corrected 1099-G.

If you are unable to access your 1099-G on UI Online, and have not received one in the mail, please submit the UI Help Form or call 401-415-6772.

UI Fraud Information

DLT is making every effort to ensure that victims of confirmed UI fraud will not receive a 1099-G form for unemployment benefits paid on a fraudulent claim.

If you receive Form 1099-G from the Rhode Island Department of Labor and Training for unemployment benefits you did not file for or receive you will not be held responsible for paying taxes on benefits that were fraudulently received using your identity.

Report Fraudulent 1099-GAny other suspected fraudulent letters should be reported only to the Rhode Island State Police.

Taxpayers do not need to file a Form 14039, Identity Theft Affidavit, with the IRS regarding an incorrect Form 1099-G. The identity theft affidavit should be filed only if the taxpayer’s e-filed return is rejected because a return using the same Social Security number already has been filed. Additional guidance from the IRS is available here.

Please click here for more information on UI Imposter fraud, including additional steps you should take to secure your identity.