Employer UI Charges

When an individual applies for unemployment, the Unemployment Insurance (UI) Division sends a Notice of Claim Filed form to the recent employers. Employers are required to return this form within 10 business days in order to have standing to contest any determination with respect to the individual’s claim.

Please complete the protest form if you need to dispute any of the following:

- an initial claim for unemployment benefits

- benefit payments being charged to your account

- report that a fraudulent claim was received by one of your employees

URGENT NOTICE TO ALL EMPLOYERS

Many employer accounts have been affected by fraudulent benefit payments being charged to their account due to imposter fraud. We have identified these improper payments and have credited (reversed) the charges so they do not negatively impact an employer’s experience rating history. These credits were processed and appear on the August benefit charge statement ("Notice of Unemployment Paid and Charged to your Account").

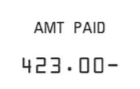

PLEASE NOTE: A negative sign (-) on your statement, shown to the right of the dollar figure, indicates that the payment is a credit, not a charge. There is no need to fill out the protest form in this instance, because the previously reported fraudulent charge has been credited back to your account.

This process will continue as we go forward to ensure employers are not charged for improper fraudulent payments.

Chargeable Employer

To be eligible for UI benefits, an individual must have been paid at least $16,800 in either the base period or an alternate base period. If they did not earn this amount, they may be eligible if they meet all of the following conditions:

- They were paid at least $2,800 in one of the base period quarters, and

- They were paid total base period taxable wages of at least one and one-half times their highest single quarter earnings, and

- They were paid total base period taxable wages of at least $5,600.

The chargeable employer is the most recent base period employer for whom the claimant was separated and had worked at least 4 weeks and earned at least 20 times minimum wage in each week.

The duration of a claim is equal to 33% of the total base period wages divided by the basic weekly benefit amount. Click here for additional information on the calculation of the weekly benefit amount as this is subject to change. The most individuals are allowed to collect of regular unemployment benefits is an amount equal to 26 full weeks. Individuals may claim these weeks any time they are unemployed during the benefit year.

For more information, including definitions, visit SECTION 28-43-1 of the RI General Assembly website.

Contact Us

Employers: (401) 243-9137